The cap and gown are hung up. The diploma has arrived in the mail. The celebration gives way to a new reality: the job offer has landed in your inbox. It’s a moment of immense pride and accomplishment. You’ve earned this.

Then you look at the salary. It’s a number you’ve worked toward for years. But is it the right number? And more importantly, what does it actually mean for the life you’re about to build in Raleigh, Charlotte, or across the country?

For students and recent graduates at NC State, this transition from academic cost to professional value is one of the most significant financial moments they’ll face. The figure on the offer letter represents potential, but the number that hits your bank account your take-home pay is what funds your independence, your student loan payments, your first apartment, and your future.

The Great Translation: From Gross Salary to Real Life

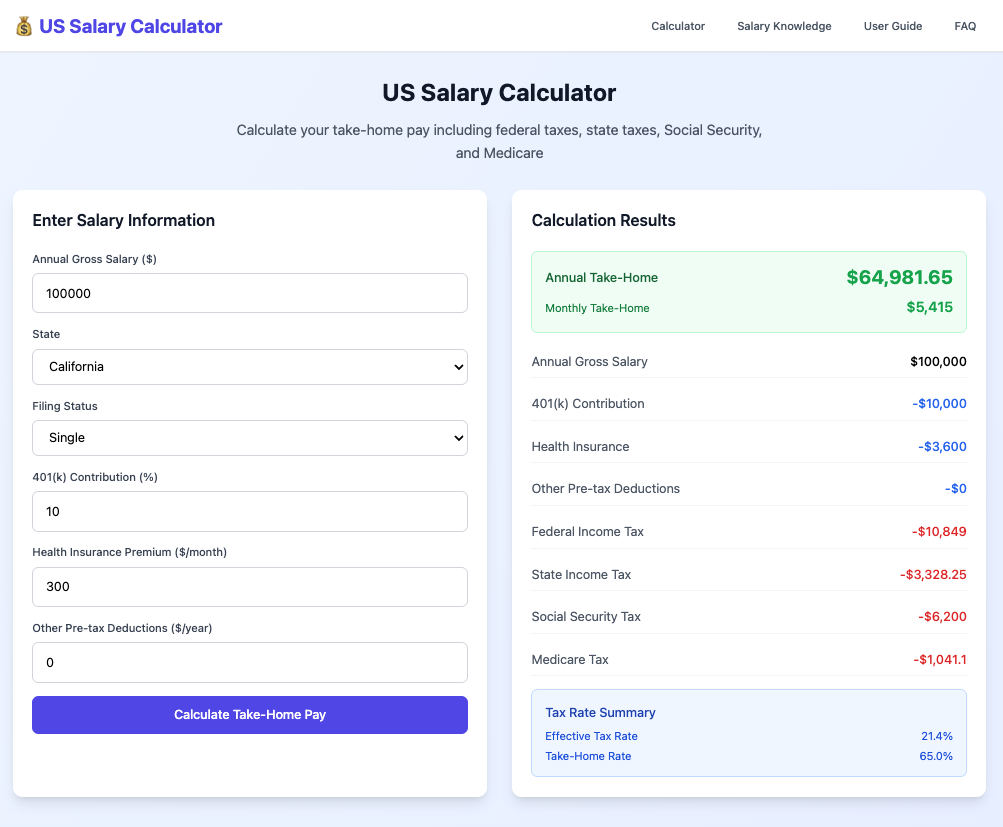

That initial salary number is just the starting point, the “sticker price.” What you ultimately earn is determined by a formula that feels mystifying at first: a mix of federal and North Carolina state taxes, Social Security (FICA), Medicare, and potentially other deductions like retirement savings or healthcare premiums.

This isn’t just about subtracting a flat percentage. It’s a nuanced calculation where geography plays a starring role. A software engineer role with the same $85,000 salary in Charlotte, San Francisco, and New York City results in three very different monthly budgets. Why? State income taxes, local city taxes, and cost-of-living adjustments create entirely different financial landscapes. A smart, modern salary calculator is built to model these geographic nuances, turning a vague estimate into a location-specific forecast.

Understanding tax brackets is another crucial step. A common fear is that a raise or bonus will “push you into a higher bracket,” somehow reducing your net pay. This is a misconception of how progressive taxation works. In reality, only the income earned above a threshold is taxed at the higher rate. A reliable tool will show this breakdown visually, proving that more gross income always results in more money in your pocket.

Your Financial Co-Pilot for Major Decisions

For a Wolfpack member entering the job market or considering a new role, this clarity isn’t a luxury it’s a strategic tool. It changes the game in several key ways.

- Negotiating with Confidence: Walking into a salary discussion armed with a precise calculation of your take-home pay in a specific city is powerful. It moves the conversation from a simple request for “more” to a data-informed discussion about real, spendable value.

- Budgeting Your New Reality: Whether planning for rent in downtown Raleigh, calculating a student loan repayment schedule, or setting savings goals, knowing your exact net monthly income is the cornerstone of any solid financial plan. It replaces guesswork with certainty.

- Evaluating the Full Package: Many offers include benefits like 401(k) matching or healthcare subsidies. The best salary tools allow you to add these in, helping you see the total compensation picture and compare offers on a truly level playing field. A dedicated tax calculator component is essential here, as it reveals how pre-tax contributions for retirement or health savings accounts can smartly reduce your taxable income.

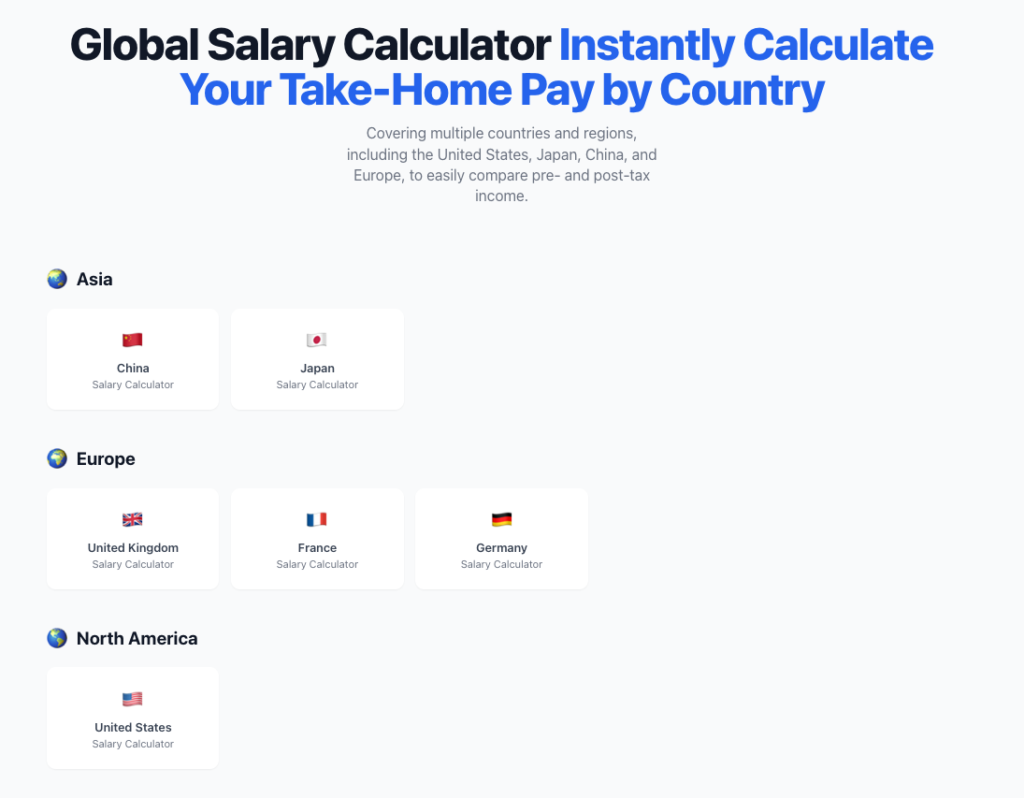

A Tool for a Global Pack

NC State’s reach is global, and so are the careers of its graduates. Whether the path leads to Research Triangle Park, a corporate HQ in another state, or an international assignment, understanding compensation requires a tool that can keep up. The most useful platforms offer dedicated calculations for different countries, accounting for everything from Germany’s wage tax classes to Japan’s residence tax. This global functionality is invaluable for graduates considering opportunities beyond U.S. borders.